After heating up like the rest of the country, the Louisiana housing market has continued to cool since interest rates began to rise in the second half of 2022. While the slowdown has resulted in a return to pre-pandemic levels of market activity, real estate agents across the state believe that an issue far greater than 7% mortgage rates may cause the housing market to slow further.

“We have an insurance problem,” said Charlotte Johnson, a Keller Williams agent based in Mandeville. “Our insurance is pricing people out of their homes.”

Between 2018 and 2023, homeowners insurance rates in Louisiana jumped 24.9%, according to an analysis by S&P Global. From 2022 to 2023 alone, rates jumped 21.2%. This has been a hard pill for many homebuyers and owners to swallow.

Marx Sterbcow, a real estate lawyer and managing attorney at Sterbcow Law Group, based roughly 40 miles north of New Orleans, insurance costs have created a rapid run-up in his annual premium. He paid $4,700 in 2022, $11,500 in 2023 and received a quote of $28,000 for 2024.

“I’m not sure what else can be done to lower the costs other than to increase the deductibles. My house has never had a claim, has all the added bells and whistles to help mitigate against any potential claim,” Sterbcow said.

Although Sterbcow is relatively close to the coast in the New Orleans metro area, increasing his property’s risk for hurricane damage, the challenge of rising insurance costs is a statewide issue.

“There are some legislative issues with insurance and taxes on insurance, but there is no doubt that we have had more severe natural disasters,” said Stephen Lovecchio, the owner of the New Orleans branch of insurance firm The Woodlands Financial Group. “The insurance companies are only trying to make a nickel on every dollar, but if we have to pay out for a $100 million or $200 million storm, rates have to go up accordingly.”

Across the state, agents feel these rising insurance costs on top of higher mortgage rates and list prices. According to Altos Research data, 90-day median list prices have risen from roughly $230,000 in April 2020 to $275,000 in early April 2024, contributing to the slowdown in home sales.

According to data from Redfin, 2,491 homes were sold in Louisiana in February 2024, down 6.2% year over year, and nearly identical to the 2,492 homes sold in February 2020 prior to the COVID-19 pandemic.

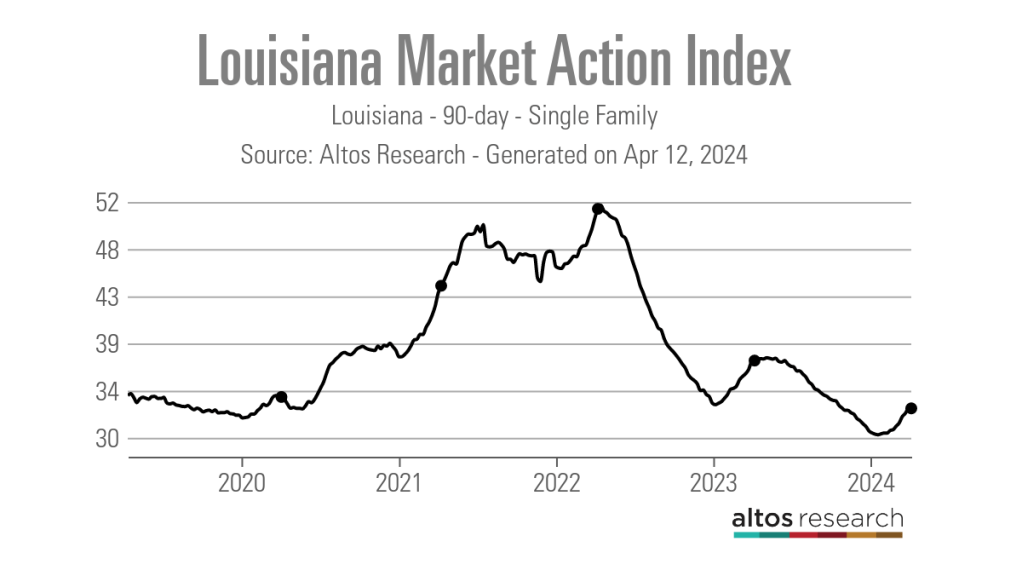

Additionally, the state’s 90-day average Altos Market Action Index score was 32.75 as of April 5, 2024 — down from 37.21 one year earlier, but nearly identical to the score of 32.77 recorded in mid-February 2020. Altos classifies scores above 30 to be indicative of a sellers’ market.

“Sellers will want top dollar for their property, but we are seeing buyers starting to look at negotiating things like closing costs or buying down their interest rate,” said Jessica Huber, a Keller Williams Realty First Choice agent based in Prairieville. “I’ve seen buyers ask for and get between $8,000 and $10,000 in closing costs covered. Prices are still higher than they were previously, but at least in my area, sellers are working with buyers.”

Another indicator of the slower market conditions is the statewide rise in inventory. After the 90-day average reached a floor of 5,010 single-family active listings in mid-April 2022, it has increased to 12,028 as of early April 2024. In comparison, statewide inventory was at 14,129 active listings in mid-February 2020.

While inventory is clearly headed in the right direction, local agents say that it is still hard for buyers at certain price points to find quality listings.

“Inventory feels pretty balanced,” said Josh Foster, an EXIT Realty Southern agent based in Sulphur. “I think we are running close to about a six-month supply, but one of the things we are still running into is that there is still not a lot of homes in that sweet spot for most buyers — right at the $200,000 to $300,000 mark, two acres with three or four bedrooms. It’s just not out there.”

With these “sweet spot”-type properties, when one does come on the market, Foster said he has seen some multiple-offer situations, but nothing like the post-pandemic surge of 2020 and 2021.

With transaction volume slowing, agents are doing everything they can to make sure the deals they have close successfully. For most, this means bringing a homeowners insurance agent into the transaction much sooner than they used to.

“Now we are getting the insurance quote before we even submit an offer on a house, so that they know what their total payment is going to be,” Johnson said. “It is a lot more legwork than before, but at least we know before we make an offer if the client can even afford their monthly payment, or even if they can get the mortgage because the insurance premium will impact their debt-to-income ratio.”

In addition to helping current buyers, agents are also working with past clients to help them manage their homeowners insurance costs.

“I’ve had people call me to list their house because they can no longer afford their insurance. So, I have been teaching people about the need to shop around for insurance,” Johnson said. “I’ve been fortunate that I’ve been able to help them find better rates so that they can stay in their home. Your insurance company doesn’t have to be your insurance company forever.”

Although the insurance challenges facing Louisiana’s real estate market will not disappear overnight, agents are hopeful for the future. Under current state laws, insurance carriers are banned from dropping homeowners who have been customers for at least three years.

In late March, however, the Louisiana House of Representatives voted to allow insurance companies more leeway in dropping homeowner policies. The bill still needs to be passed by the state Senate, but agents are hopeful the change would entice more carriers to offer coverage in higher-risk areas, giving homeowners and buyers more choices.

“The reinsurers see this rule and they don’t want to be part of things in Louisiana — they don’t want to come here,” Johnson said. “So, we have a situation where we don’t have competition and so that is driving up the prices even higher.”

Lovecchio also noted that he expects insurance premiums to decline in the coming years.

“The new insurance commissioner is allowing companies to raise and lower rates a lot quicker, so hopefully consumers will see less lag time on their rate changes,” Lovecchio said.

“I think prices will moderate a bit moving forward. We’ve seen them stop going up, so that is good — it is the first step. But we also hope some more carriers will enter our markets and bring them lower because we really need rates to go down.”