Apr 11, 2024 | News

Mortgage rates shot up today as the CPI data came in just a bit hotter today — 0.1% more than estimates on a month-to-month basis. That’s not much, but it’s high enough to take away one of the rate cuts we expected in 2024. I view rate-cut pricing being tied more to...

Apr 10, 2024 | News

Founder, chief executive, and president of Los Angeles-based TruAmerica Multifamily, Bob Hart is the very definition of a commercial real estate industry leader. It’s fitting, therefore, that he should be among the panelists on the “Industry Leaders: A View from the...

Apr 10, 2024 | News

Mortgage brokers’ compensation is in the spotlight after a recent Federal Deposit Insurance Corporation (FDIC) test concluded that some financial institutions failed to prove that payments were “reasonably related” to the value of services provided. In its March...

Apr 10, 2024 | News

Michael M. Santiago/Getty Images Those anticipating a meaningful drop in mortgage rates might be disappointed. Inflation jumped in March, giving the U.S. Federal Reserve ammunition to hold off on those eagerly awaited interest rate cuts. For the fourth month running,...

Apr 10, 2024 | News

Mortgage demand increased slightly for the first time in four weeks, with a modest uptick in refinance applications leading the way. But don’t expect it to continue. Mortgage applications increased by 0.1% on a seasonally adjusted basis during the week ending April 5,...

Apr 10, 2024 | News

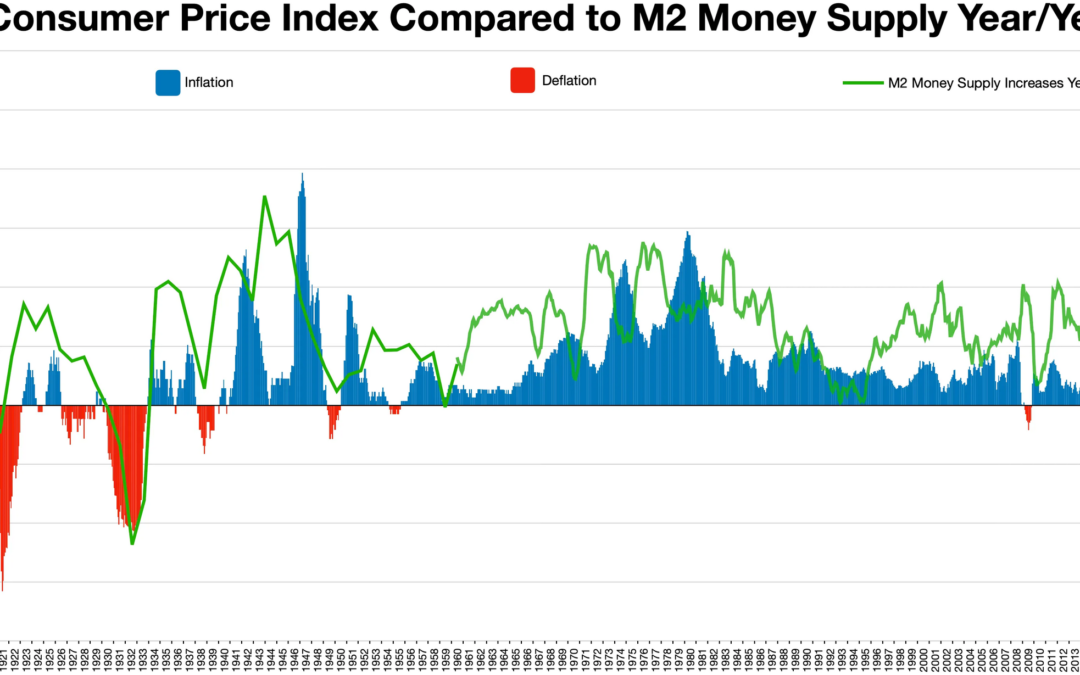

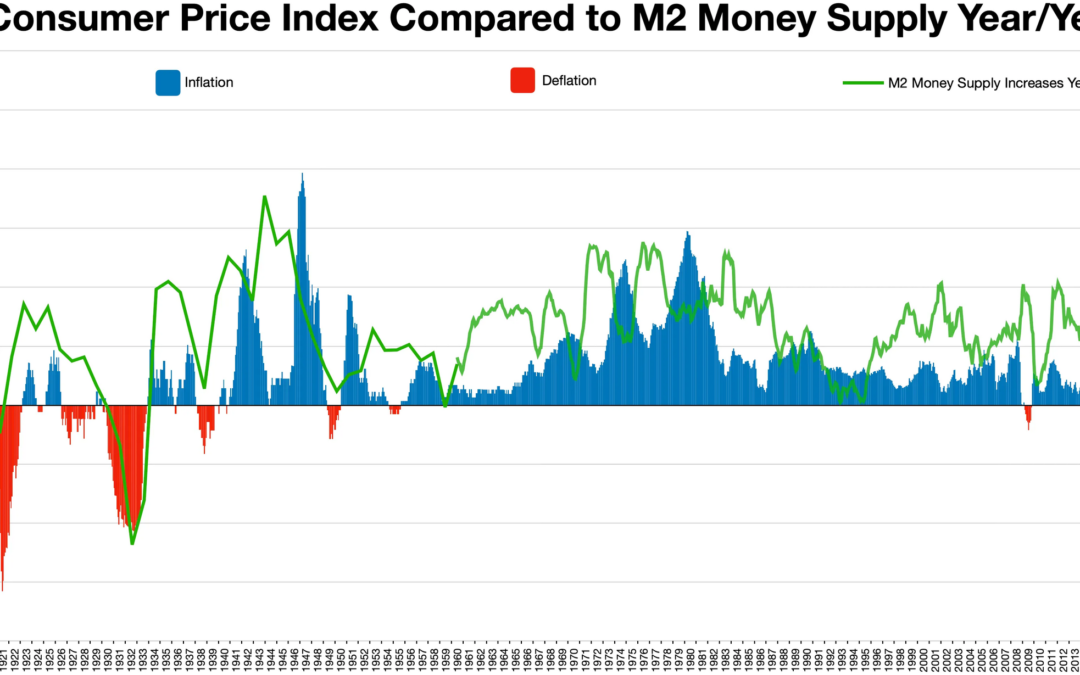

The March inflation report came in hotter than expected, which means the Fed is highly unlikely to cut interest rates in June–and could mean the Fed only cuts rates once this year. The news is already pushing up mortgage rates. Higher-than-expected inflation in March...

Apr 10, 2024 | News

The most anticipated economic report of the month showed that inflation has not just stalled, but increased. The news almost certainly rules out a rate cut in June, and traders are increasingly skeptical there will be more than a couple cuts in 2024, if any at all. ...

Apr 10, 2024 | News

One economist said consumers appear to be adjusting their expectations for the housing market to better accommodate higher mortgage rates and home pricing. WASHINGTON – While a growing number of consumers think mortgage rates will increase in the coming year, their...

Apr 10, 2024 | News

CONSUMER PRICE INDEX – MARCH 2024The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in March on a seasonallyadjusted basis, the same increase as in February, the U.S. Bureau of Labor Statistics reported today.Over the last 12 months,...

Apr 10, 2024 | News

President Joe Biden on Monday announced his plans to provide student loan debt relief to more than 30 million borrowers. At first blush, that appears to be a boon to the housing market. It could help more buyers, particularly first-time buyers, save up extra money for...