When they say housing leads the U.S. economy into and out of a recession, they’re correct, as housing starts fall into a recession and rise when we are recovering. Economic cycles follow a familiar pattern, however, each one is unique in its way.

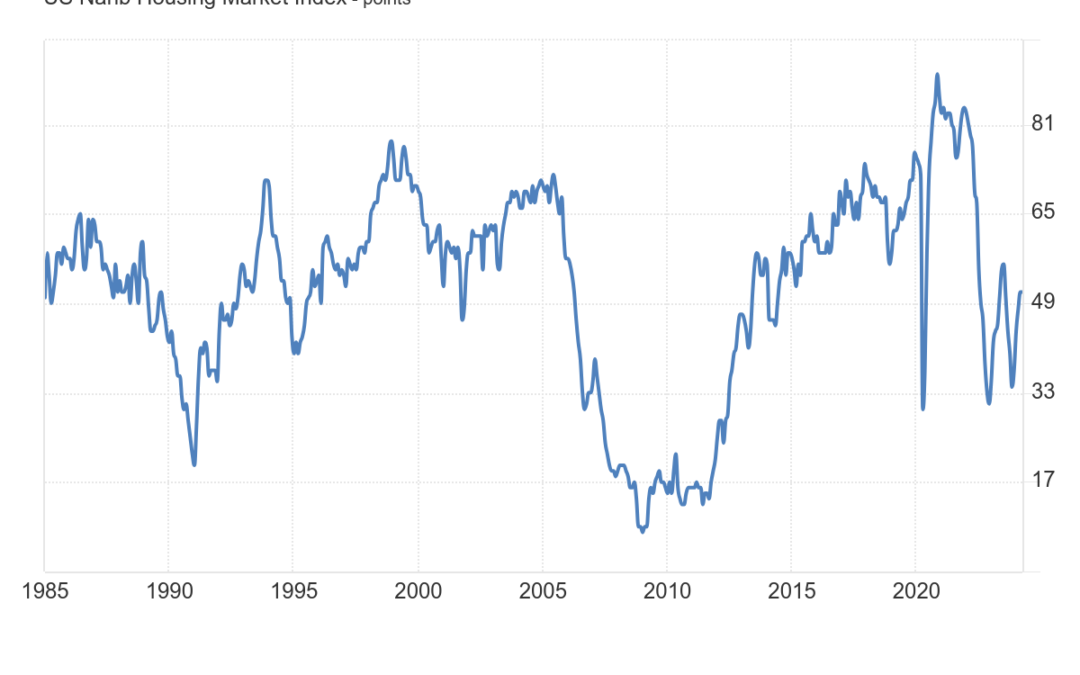

In 2022, many recessionary red flags popped up. However, after Nov. 9, 2022, a critical recessionary data line changed as mortgage rates fell, new home sales grew, builders bought down rates and the cycle moved on. You could see this in the builders’ confidence data.

Last year, as rates rose toward 8%, the builders’ confidence fell, and then, as rates fell, their confidence rose again. The most recent NAHB survey shows builders’ confidence has stalled, and it will most likely head lower soon! Why has this happened?

The 10-year yield broke a key support line last week, just like last year, and it wants to test 5% again. It’s currently at 4.65%. This means mortgage rates are higher than they’ve been all year, and, as I talked about last year on CNBC, higher mortgage rates are never good thing for housing.

I haven’t been a Fed pivot person since 2022 — I don’t think the Fed will pivot until the labor market breaks. I recently discussed how high mortgage rates can go in the HousingWire Daily podcast.

So, how should we approach the housing starts data to understand when a job loss recession will happen? Follow this journey with me.

As we can see below, recessions traditionally don’t start until residential construction jobs are lost. This isn’t just people who work in apartments and single-family homes, as remodeling employment is also high here. As we can see below, we haven’t shed residential construction jobs yet, and we haven’t gone into a job loss recession either. Also, remember we are an aging society, and baby boomers leave the workforce each month. Many companies are mindful of keeping the right amount of labor in their workforce.

Residential workers fall before the recession as higher rates bite.

Now, let’s look at housing permit data. As we can see in the chart below, 5-unit permit data is already at the low levels of the COVID-19 recession. As crazy as this sounds, we also have a shot at having this data line reach Great Financial Recession lows.

Since January 2023, as 5-unit permits have fallen, single-family permits have risen. But that’s not what we see in this report: single-family permits fell in this report. As we can see below, when both data lines fall together over time, it eventually leads to construction workers losing their jobs and jobless claims rising, which is how each recession has worked.

We are not in the danger zone yet, as we have a hefty backlog of construction work that needs to be finished. However, I am creating a pathway for you to walk to in the future.

*Notice how permits for single-family and five units tend to fall together before the recession.

Housing starts are growing yearly, and 5-unit starts are collapsing. In 2021, I wrote a critical piece stating that once mortgage rates rise and builders start to make less money building, they will fold like they always do. This is an excellent example of why I say builders aren’t the March of Dimes.

A huge gap between housing starts and 5-unit starts has been forming.

I wanted to keep this housing starts report straightforward today to get people to look ahead in the future and connect the dots, because the Fed will only pivot once the labor market breaks, when they see jobless claims rising. That, in turn, will lead to lower mortgage rates as the bond market sniffs out accurate recessionary data and takes yields and mortgage rates lower. Until then, mortgage rates and bond yields will be elevated.